does kansas have estate tax

Median property prices are currently around 160000 and are rising. It offers a refund of up to 75 of your property tax payments from the last tax year as well as.

Estate And Inheritance Tax State By State Housing Gurus

The median home value in the state is slightly below the example above but at.

. Kansas has a property tax rate 140. In addition to taxes car. The average property tax rate in Kansas sits at 137 which is considerably higher than the US.

That means the annual tax on a 194000 home is 2713 per year. The Ohio estate tax was repealed as of. Counties in Kansas collect an average of 129 of a propertys assesed fair.

The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000. Your average tax rate is 1198 and your marginal tax rate is. SAFESR Spreadsheet - Automatically determine which claim results in the greater refund Homestead or SAFESR.

Here are the top five things homeowners need to know about property taxes in Kansas. National average of 107. Kansas collects a 73 to 8775 state sales tax rate on the purchase of all vehicles.

Kansas has a graduated individual income tax with rates ranging from 310 percent. Connecticuts estate tax will have. Kansas does not have an estate tax but residents of the Sunflower State may have to pay a federal estate tax if their estate is of sufficient size.

If you make 70000 a year living in the region of Kansas USA you will be taxed 12078. Kansas does not have an estate tax or inheritance tax but there are other state inheritance laws of which you should be aware. Seven states have repealed their estate taxes since 2010.

Taxes in Kansas Kansas Tax Rates Collections and Burdens. The Kansas Safe Senior exemption is designed to support low-income senior citizens in Kansas. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Kansas Property Tax Relief for Low Income Seniors. Delaware repealed its tax as of January 1 2018. There are also local taxes up to 1 which will vary depending on region.

City and county property tax jumped 168 between 1997 and 2018. Kansas Income Tax Calculator 2021. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

States That Have Repealed Their Estate Taxes. How does Kansass tax code compare.

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

Irs Announces 11 7 Million Exclusion For 2021 Estate Planning Attorneys In Missouri And Kansas

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Transfer On Death Tax Implications Findlaw

The Estate Tax And Real Estate Eye On Housing

Welcome To The State Death Tax Manager Leimberg Leclair Lackner Inc

Does Kansas Charge An Inheritance Tax

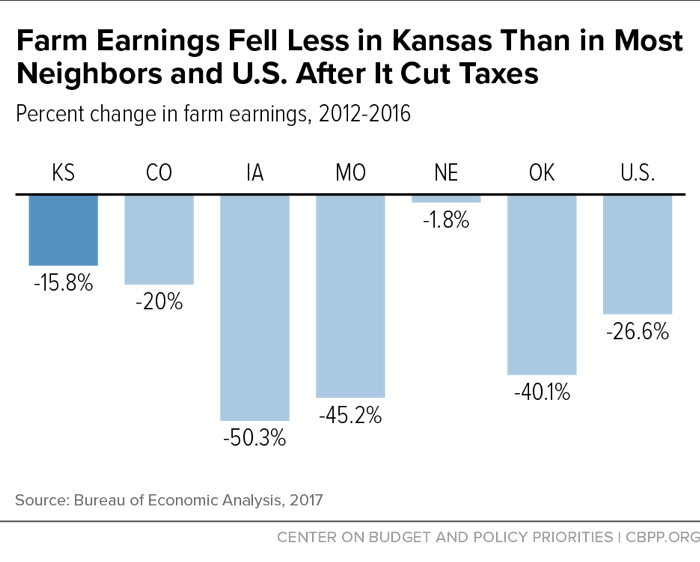

Kansas Provides Compelling Evidence Of Failure Of Supply Side Tax Cuts Center On Budget And Policy Priorities

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

Kansas Inheritance Laws What You Should Know

State Estate And Inheritance Taxes Itep

Frequently Asked Questions About Probate Kansas Legal Services

Proposed Changes To Estate Taxes Threaten Farmers And Ranchers Kansas Living Magazine

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

States With No Estate Tax Or Inheritance Tax Plan Where You Die

K 41 Fill Out And Sign Printable Pdf Template Signnow

:max_bytes(150000):strip_icc()/how-long-to-keep-state-tax-records-3193344-V22-3972fe8732794cc596ab2cac3cd979c3.png)

How Long Does Your State Have To Audit Your Tax Return

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Delinquent Real Estate Unified Government Of Wyandotte County And Kansas City