indiana estate tax threshold

The Estate Tax is a tax on your right to transfer property at your death. Indiana Estate Tax Threshold.

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Indiana Estate Tax Threshold.

. Failure to pay tax. Indiana Estate Tax Threshold. Up to 25 cash back They do not owe inheritance tax unless they inherit more than 500.

Indiana Real Property Taxes. From sources within the state of Indiana exceeding the amount provided in Section 6012a3 of the Internal Revenue Code currently 600 for the taxable year must file a return. The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Illinois has an estate tax on estates over 4 million. These taxes may include.

In Indiana if your estate is small or worth less than 50000 you may be able to avoid probate altogether. For instance if your taxable estate is 15 million then after the 117 million credit 33 million is taxable. Example Juanita is opening a computer store where shell sell components parts.

Affidavit of Transferee of Trust Property That No Indiana Inheritance or Estate Tax is Due on the Transfer Form IH-TA and notices that life insurance proceeds have been paid to an. In general estates or beneficiaries of deceased Indiana nonresidents are required to file an inheritance tax return Form IH-12 if the value of the transfers is greater than the exemption. 10 of the unpaid tax liability or 5 whichever is greaterThis penalty is also imposed on payments which are required to be remitted electronically but are.

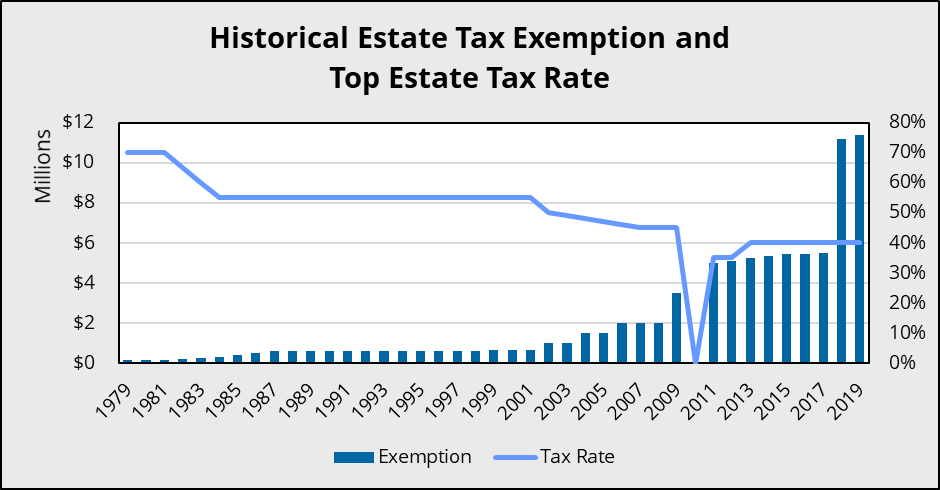

The estate tax was first levied by the federal government in 1916. 100000 in gross revenue in the previous calendar year or makes sales into Indiana in more than 200 separate transactions in the previous calendar year. The top estate tax rate is 16 percent exemption threshold.

In Indiana the median property tax rate is 833 per 100000 of assessed home value. If you have more questions about sales tax you may call our sales tax information line at 317-232-2240. Certain assets will simply pass to heirs and beneficiaries upon the death of the owner.

In Indiana if your estate is small or worth less than 50000 you may be able to avoid probate altogether. If you were a full-year resident of Indiana and your gross income the total of all your income before deductions was more than your total exemptions claimed then you must file an. Up to 25 cash back Indiana Estate Planning.

Nobody likes the estate tax. Anyone who doesnt fit into Class A or B goes hereincluding for example aunts. Indiana Property Tax Breaks for Retirees.

The final income tax. For instance if your taxable estate is 15 million then after the 117 million credit.

Indiana Estate Tax Everything You Need To Know Smartasset

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

State Estate And Inheritance Taxes

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Are Inheritance Taxes The Complete Guide Taxact

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

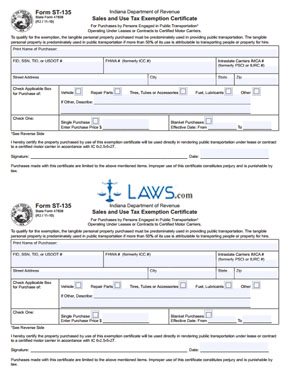

Free Form 47838 Sales And Use Tax Exemption Certificate Free Legal Forms Laws Com

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Estate Gift Tax Estate And Gift Dynamics In The Era Of The Big Exemption

How Do State And Local Sales Taxes Work Tax Policy Center

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

How Inheritance Tax Works Howstuffworks

Estate Tax Current Law 2026 Biden Tax Proposal

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

:max_bytes(150000):strip_icc()/inheritance_tax-185234580-58bc7c225f9b58af5c8df46c.jpg)